UK ⇆ USA Shipping Rates 2025

UK ⇆ USAGet a Shipping Quote

Welcome to DFSWorldwide, the leading UK-based freight company specializing in air and sea freight services to the United States’ major seaports and airports. Our competitive rates and dedication to excellence ensure your cargo reaches its American destination safely and efficiently.

Air Freight

| AOL |

+45 Kgs |

+100 Kgs |

+500 Kgs |

+1000 Kgs |

| LHR | £1.20 | £1.15 | £1.00 | £0.90 |

- Rates Valid for: Boston, Chicago, Detroit, Newark, Seattle, Las Vegas.

- All rates exclude any Ex Work charges

- Minimum: £70

Air Freight Rates UK to USA

| AOD | Min. |

+45 Kgs |

+500 Kgs |

+1000 Kgs |

| JFK | £60 | £1 | £0.75 | £0.75 |

| LAX | £70 | £1 | £0.75 | £0.75 |

| MCO | £60 | £1 | £0.75 | £0.75 |

| MIA | £60 | £1.65 | £1.45 | £1.45 |

- Rates above exclude collection, screening, handling, export declaration, documentation.

- Please contact us for the latest air freight rates.

- AOL: London Heathrow

- New York: JFK, Los Angeles: LAX, Orlando: MCO and Miami: MIA.

- Minimum: £60

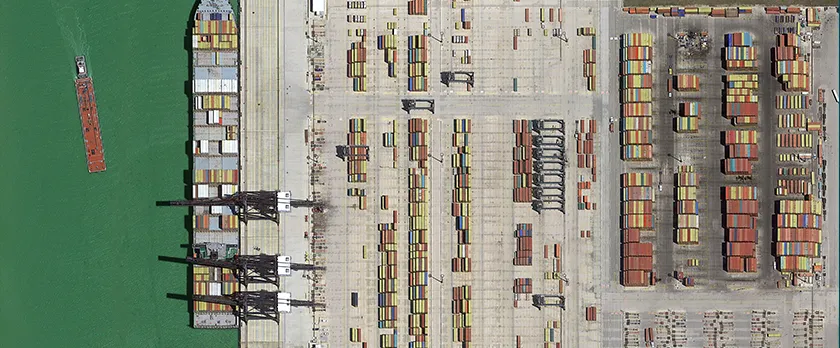

Sea Freight

FCL - USA To UK

| POL | POD | OCF USD 20' GP |

OCF USD 40' GP |

OCF USD 40' HQ |

| Houston | London | 1110 | 1155 | 1155 |

| New York | Southampton | 740 | 705 | 705 |

| Los Angeles | Southampton | 1875 | 2140 | 2140 |

FCL - UK To USA

| POL | POD | OCF USD 20' GP |

OCF USD 40' GP |

OCF USD 40' HQ |

| London | Houston | 2775 | 3490 | 3490 |

| Southampton | New York | 2775 | 3490 | 3490 |

| Southampton | Los Angeles | 4020 | 5435 | 5435 |

Indicative pricing only, other ports are available on request.

- Custom clearance, documentation and local charges are not included.

- Terms and Conditions apply.

- $ rates in USD

- Rates are indicative only.

LCL - USA TO UK

| POL | OCF W/M |

THC W/M |

DOCS |

| New York | $57 | £42 | £55 |

| Los Angeles | $80 | £42 | £55 |

| Houston | $57 | £42 | £55 |

Rates are indicative only

POD London

LCL - UK TO USA

| POL | OCF W/M |

THC W/M |

DOCS |

| New York | $57 | £18 | £55 |

| Los Angeles | $88 | £18 | £25 |

| Houston | $57 | £18 | £25 |

Rates are indicative only

POL London

All USA rates are currently subject to strike congestion surcharges.

Rate terms:

- Based on 1 Cbm not exceeding 1000 Kgs in weight.

- Subject to the final weight/dimensions and are based on commercial collection and delivery address with access/parking for an artic vehicle. Any special requirements such as tail lift, timed delivery etc will result in additional charges.

- Non palletised cargo will incur a fee of £ 15 per pallet.

- Based on general non haz, stackable cargo, unless stated otherwise and can only be used for standard pallet sizes.

- The exchange rate used is based on the current month and is subject to fluctuate.

- Subject to space, equipment, sailing and vessel availability.

- Subject to PSS and Emergency Contingency surcharges.

- Port to port inclusive of OCF, THC, Docs.

- Excluding: Any charges at origin, imports customs clearance, import duties & taxes, any storage/detention, delivery.

USA trade and export guide

A guide for UK businesses interested in selling goods and services in the US.

Doing business in the US

The United States (US) is the largest, most competitive and technologically advanced economy in the world. US Gross Domestic Product GDP has consistently seen growth of 1.8% or more since 2011. It is the UK’s top export destination.

The US is the world’s largest market and it has the world’s largest private sector. It also has:

- low regulatory barriers

- minimal language barriers

- access to global supply chain, which can lead to exports for other markets

- a strong rule of law

Industries importing into the US

The top 10 industries importing into the US are:

- electrical machinery and equipment

- machinery and mechanical appliances

- vehicles

- mineral fuels and oils

- pharmaceuticals

- optical, photographic, cinematographic, measuring and precision equipment

- furniture, mattresses and soft furnishings

- pearls, precious and semi precious stones and metals

- organic chemicals

- plastics

You can read more about what the US imports at WorldsTopExports.com.

The International Trade Centre (ITC) ranks the US’s top services imports.

Researching the US market

You should do as much market research and planning as possible before starting to sell your products and services in the US using both desk research and visits to the market. Good planning is essential as this will protect you from litigation and product liability exposure.

Litigation is best avoided by getting a good understanding of US commercial standards and tailoring your company’s practices to those standards.

To avoid product liability exposure you must:

- assess US government requirements, voluntary standards and industry practices for your product

- evaluate your existing internal processes for product development and safety, incident reporting and investigation and response

The US is not a single national market; it is a federal system. You must treat each state as a separate entity with its own procedures. You need to determine the implications of developing your business in a specific state, or whether national entry is possible for your product or service.

You need to determine whether:

- there is a market for your product or service

- your pricing is competitive

- you need to localise your product

Getting started in the US market

There are a number of options to enter the US market. You need to consider which one will best support the successful introduction of your particular product or service into the market.

Using local representation to export to the US

Establishing local representation can be a good way to test the market on a short-term basis. You will need to find the appropriate partner(s), taking into account whether you are planning to sell to specific US states or the entire country. Direct sales through local representation involves collaboration with a US-based:

- agent or representative

- distributor or dealer

You must ensure you’re aware of the differences between these options and whether exclusive arrangements work best or not.

You should take and keep the initiative in drafting contracts and non-binding summaries of key terms (also shortened to NB-SOTs) or ‘letter of intent’ with your representative to ensure a good contract.

Sales through a local branch or subsidiary in the US

Establishing a US subsidiary or trading company is the best choice for a long-term commitment to the US market as it gives control over your brand. However, this option involves taking into account a number of extra costs.

Different states offer varying business entity options. For most UK companies a corporation is the best choice of US entity, as opposed to a branch of your existing UK entity.

UK businesses need to consider:

- how close they need to be to customers

- where to locate for tax purposes

- where to find appropriately skilled employees

- which time zone suits their business

You must get advice from a local lawyer as to the best business entity suited for your tax or other needs.

Joint venture or strategic alliance in the US market

You need the right partner for a joint venture (JV) to work in the US market. You should get your US lawyer to do ‘due diligence’ on your prospective partner. An accountant is essential for tax planning.

You should begin contract negotiations with your partner by preparing and working to the signature of an NB-SOT.

Online selling in the US

You can sell your products and services over the internet through:

- your own website which will need to be adapted to support US electronic payments/credit cards, US addresses and zip codes

- an online marketplace

Read our E-commerce for UK small businesses selling online to the USA brochure for information on US e-commerce rules and regulations.

Use the UK government’s selling online overseas tool to find the best place to sell your products online. You can also take advantage of special deals negotiated by the government for UK businesses.

Find out about DIT’s e-exporting program

You must not charge Value Added Tax VAT for online sales to the US. You must fill out a customs declaration when you ship the products and keep the ‘proof of export’.

Licensing and technology transfer to and within the US

To successfully license your technology in the US you should ensure:

- your intellectual property (IP) is protected before negotiating an agreement

- ‘due diligence’ is done on licensee candidates through your US lawyer

- control of the contract drafting using an NB-SOT as the first negotiation document

- the contract is drafted so as to minimise risks of violating antitrust, patent misuse or other laws

- the contract protects your rights in any trademark

- the contract specifies your choice of tribunal and law

- tax impact is considered

You must be aware of federal and state franchise legislation if you intend to license computer software or set up authorised reseller agreements.

Virtual presence in the US

This involves having a US presence of some kind by way of a virtual office or staff who represent your interests in a more or less permanent way. This could be as simple as an American ‘1-800’ toll-free phone number which connects your US callers directly to your UK office for a minimal monthly or per-call charge. Or you could have a US mailing address using any of the many post office box services based across the 50 states.

Own office with own staff or partner’s staff in the US

You can put your own managers and staff on the ground in the US and start your office or you can work through a partner via a joint marketing agreement or strategic alliance. Both options have advantages and disadvantages, including visas if you place UK staff in the US.

Contract sales consultants in the US

You can hire a task-force, which involves paying a marketing consulting firm, contract sales force or marketing organisation for a fixed period to go out and find leads for you in the US and feed them back to your UK base.

Company acquisition in the US

You can get market share in the form of a competitor or supplier that is already in the US. This gives you instant presence, market intelligence, access to customers and complete quality control and infrastructure.

Getting finance to fulfill an export contract to the US

Schemes are available to UK companies selling products and services to the US to make it easier to fulfill an export contract and grow your business. Contact your bank or specialist financial organisations for assistance.

UK Export Finance (UKEF) has significant risk capacity to support exports to the US. Contact one of UKEF’s export finance advisers for free and impartial advice on your finance options.

Getting paid in the US

Your contract will specify the terms for payment. If there is any dispute you will need to go through the US legal system for resolution. This generally takes place in the US state specified in the contract and abides by state laws.

UKEF helps UK companies to get paid by insuring against buyer default.

Be confident you’ll get paid for your export contract. Speak to one of UKEF’s export finance advisers for free and impartial advice on your insurance options or contact one of UKEF’s approved export insurance brokers.

Currency risks in the US

If you have not fixed your exchange rate you have not fixed your price. You should consider whether the best option for you is to agree terms in sterling or US dollars in any contract.

You may wish to consider ‘hedging’ where there is a risk of exposure by agreeing a forward contract with a bank.

Transferring money from US

Capital can be moved in and out of the US without any restrictions, however sums over a certain amount may be flagged by your bank. A Currency Transaction Report is normally filed by the bank to the Financial Crimes Enforcement Network for transferring a sum of over $10,000.

Setting up a US bank account

Opening a bank account in the US can be challenging as you won’t have a US credit record. Some US banks will offer accounts to UK companies who have accounts with a UK affiliate. Contact your local branch and ask about your options for opening a US account.

Legal considerations of doing business in the US

You should always get qualified legal guidance before entering into any agreement. Ideally, your contracts should be reviewed by lawyers who understand both US and UK law. You can also find useful information at:

- a list of state bar associations in the US

- the US Embassy, which maintains a list of American attorneys based in the UK

- the American Bar Association, which has a list of US law firms

All corporations in the US have to register with a government body in the state they incorporated in. Business filing documents are available through the relevant state government authority. US publicly traded companies (PLCs) have to file with the Securities and Exchange Commission (SEC) and must make their annual reports available to investors.

Privately held companies don’t have to make this information available to the public.

Controlled goods export licences for the US

A license to export to the US is required for:

- goods on the UK Military List

- more sensitive items on the EU Dual-Use List (goods along with their associated technologies that can be used for both civil and military purposes)

- goods that could be used for restraint, repression or inhumane treatment

Check with the UK’s Export Control Organisation (ECO) whether you require an export licence for your goods.

Other export licensing requirements for the US

You may need a licence or to follow special rules to export certain goods.

Check if products and services require certification or licensing before export.

Importing controlled or restricted goods into the US

The US International Traffic in Arms Regulations ITAR is a set of US government regulations that control the export and import of certain defence related articles and services on the United States Munitions List (USML).

Before attempting to export military or dual use goods to the US, UK companies should research whether they are subject to ITAR. You must consider any future restrictions that may be placed upon your export as a result of ITAR before entering into any formal contract.

Contact DIT Defence & Security Organisation (DSO) for more information on ITAR and how it could impact your exports.

Read the US Customs & Border Protection’s (CBP) list of prohibited and restricted items to check US regulations on the import of certain goods.

Insurance in the US

Due to the extent of US litigation and the complex liability law, you may find that your UK insurer won’t cover your requirements. You can work with a US insurer or broker even if you don’t have a physical US presence.

US product liability law

You should make sure you understand product liability law and implement precautionary measures to reduce risk. These involve an investment of time and money and are an in-built cost of doing business in the US.

You can minimise product liability risk through:

- quality control procedures

- being responsive to field complaints and having clear documentation as proof of your response

- regular audits of product literature to ensure clear instructions about safety

- effective risk management to manage safety compliance

- document retention and staff training around product design, manufacture, marketing and field experience

- product liability insurance

Standards and technical regulations in the US

You must check your product meets all legal requirements in the US and you have all the required licences. Failure to comply can result in a lawsuit.

Visit the National Institute of Standards and Technology for more information on legal standards.

Check the US Food and Drug Administration FDA legislation and regulation relating to food and drink, drugs, medical devices and cosmetics.

Certain products can be tested and certified for the US market by private industry organisations.

Packaging regulations in the US

The FDA regulates the packaging and labeling of food, pharmaceuticals and cosmetics at a federal level. States or local jurisdictions have introduced regulations around the use and disposal of certain packaging materials, and have set minimum recycling requirements.

Product labeling in the US

US labeling regulations and laws are complex as the system operates through:

- federal and state regulations

- product category and substance regulations

- safety standards and acts

Labeling requirements for consumer commodities are controlled by the Fair Packaging and Labeling Act. It is enforced by the FDA and Federal Trade Commission (FTC) and requires:

- product identification

- name, place of business of the manufacturer, packer or distributor

- net quantity of contents (both metric and US customary) units

The FDA has specific labeling requirements for food, drugs, cosmetics and medical equipment. Cosmetics must also conform to the Food, Drug and Cosmetics Act and the Safe Cosmetics Act of 2011.

Read more about labeling requirements on the FDA website.

Check the FTC’s website for information on labeling requirements for non-consumer commodities.

Check labeling requirements set out by the Consumer Product Safety Commission (CPSC).

Check with the relevant state business bureau for information on local regulations.

Intellectual property in the US

The US has comprehensive intellectual property (IP) laws with strong legal enforcement against infringement, offering a high standard of protection for rights owners.

You should actively monitor the marketplace for any unauthorised use of your IP, including online. You should take expert legal advice before contacting an offender or pursuing any sort of litigation. IP law in the US is complex and should only be used when other enforcement methods have failed.

If you intend to sell goods or services to the US, you should consider applying for US trademark protection. You also need to check that your trademark doesn’t infringe any existing trademark. In the US, a company name is not the same as a trademark and will only give limited protection.

Find out more about protecting your patents and trademarks at the United States Patent and Trademark Office (USPTO).

You can register copyright at the United States Copyright Office.

Taxation in the US

The US tax system is complex. Taxes can be imposed by both the US federal government and individual states, counties and cities. The Internal Revenue Service governs federal taxes in the US.

UK companies with US customers may be subject to US direct or indirect taxes. This generally depends on the nature and extent of the UK company’s connections with the US and can vary according to whether it does business:

- through a US office or US-based employees or agents

- through a US subsidiary

- directly from the UK

If you conduct US transactions entirely from the UK, you may be classed as withholding US federal income tax. You may be eligible for benefits under the US-UK income tax treaty. In some circumstances you may be wholly or partially exempt from certain US federal income taxes under this treaty.

The UK and the US have signed a double taxation agreement ensuring the same income is not taxed in more than one country.

You’ll need tailored tax advice from a certified accountant or tax lawyer about tax consequences if your UK company conducts activities in the US or transactions with US customers. You taxation situation will depend on the specific facts and circumstances of each particular situation.

Sales tax in the US

There is no Value Added Tax VAT in the US. Each state determines and collects sales tax on an individual basis. You can find state tax information from the Federation of Tax Administrators.

If you’re VAT registered you can zero-rate the VAT on most goods you export to the US. You will need to get evidence of the export within 3 months from the time of sale.

Find out more about VAT on exports to non-EU countries and zero rating conditions.

Read more about sales tax in the US from Vat Live.

Customs and documentation for the US

Complying with HMRC regulations to export outside the EU

You must make export declarations to HMRC through the National Export System (NES) to export your goods to the US.

Find out how to declare your exports through the NES to the US.

You must classify your goods as part of the declaration, including a commodity code and a Customs Procedure Code (CPC).

Find commodity codes and other measures applying to exports in the UK Trade Tariff.

Find out how to contact the HMRC Tariff Classification Service for more help.

You must declare any goods that you take with you in your baggage to sell outside the EU.

US import documentation and duty

The following documents are generally required for the importation of goods into the United States:

- air waybill

- bill of lading

- binding ruling

- cargo release/simplified entry

- customs bond

- customs import declaration

- entry/immediate delivery

- importer security filing and additional carrier requirements

- manifest for aircraft

- manifest for vessels

Use the US International Trade Commission database to determine your duty rates.

You can find out more about import conditions in the US on the Market Access Database.

If you know where your goods will enter the US, you can speak with a customs agent at the port of entry or hire a licensed customs broker. A broker can help you with federal procedures and submit information and payment to CBP on your behalf.

Temporary export of goods to the US

You can use an Admission Temporary Carnet (ATA Carnet) to simplify the customs procedures needed to temporarily take goods into the US.

You need an export licence to temporarily take military or dual use goods out of the UK.

Use the SPIRE system to apply for a temporary export licence.

Temporary import of goods into the US

There are several options to move commercial samples in and out of the United States:

- payment of duty

- temporary importation under bond (TIB)

- ATA Carnet

If you’re bringing/shipping supplies to the US to exhibit at a trade show you’ll need:

- official documentation showing date and location of trade show

- confirmation you’re an exhibitor

- documentation indicating value of items

- to mark items ‘not for sale’ or to make them unfit for sale

- to contact port of entry prior to arrival

- check with US government agency regulating your product for any possible restrictions or required documentation

- obtain Harmonized Tariff Schedule of the US (HTSUS) code for your items

Find more information on options to import commercial samples into the US.

Shipping your goods to the US

If you are not knowledgeable about international shipping procedures you can use a freight forwarder to move your goods. A forwarder will have extensive knowledge of documentation requirements, regulations, transportation costs and banking practices in the US.

Find freight forwarding companies to help you transport your goods to the US via British International Freight Association (BIFA) or the Freight Transport Association (FTA).

Posting goods to the US

You can usually send samples of your business’s goods through the normal postal system. Your local post office can be used to export small orders to the US which are easily packaged and are within the current weight restrictions.

If you’re sending goods by post you must check that the items are not prohibited or restricted by mail services in the UK and in the US.

Find out more about prohibited or restricted items in the US on Royal Mail’s website.

When using postal services on a more commercial basis you must complete the required customs form with the commodity code that relates to the goods you using the post to export.

For bigger orders, most businesses use a courier or freight forwarder.

Shipping dangerous goods to the US

Special rules apply if you are shipping dangerous goods to the US.

Terms of delivery in the US

Your contract should include agreement on terms of delivery using Incoterms.

Language and culture in the US

Business communications in the US tend to be very direct. Getting straight to the point is appreciated and negotiations are likely to be very focused on closing a deal. The fine detail of the legal aspects of a contract or written agreement are likely to be heavily scrutinised.

Opportunities for UK businesses in the US

DIT provides free international export sales leads from its worldwide network. Find export opportunities in the USA.

Washington DC and New York are home to the World Bank and United Nations. These aid agencies can offer excellent opportunities to UK companies. The World Bank, United Nations and other aid organisations spend over $180 billion on goods and services each year.

Email the US market export team who can help you break into the US market.

Contact DIT DSO for more information on exporting defence and security products to the US and to find out how ITAR regulations could impact your exports.

Find out more about exporting military and dual use goods.

Challenges and overseas business risk in the US

The US is a large market to do business in. This can lead to some unique challenges:

- vast regional differences between the 50 markets/states

- strong competition, causing saturation of products or services

- high customer service expectations

- high cost of living in major cities

- significant time difference (between 5 and 8 hours behind)

- high cost for business insurance

- litigation is common

- expensive and time consuming process for work visas

You should ensure you take the necessary steps to comply with the requirements of the UK Bribery Act.